You can have the smoothest trucking fleet, the best sea freight rates, or a confirmed seat on tonight’s flight out of O. R. Tambo, yet one missing code or under-declared value will park your cargo in a bonded store, racking up storage fees and angry phone calls.

Customs clearance is the critical handshake between your shipment and the South African Revenue Service (SARS). Get it right, and boxes sail through the green lane, get it wrong, and they stall while penalties pile up.

For Transglobal Cargo, customs brokerage isn’t just paperwork, it’s risk management. The company’s licensed declarants, full-time tariff specialists, and 24 / 7 tracking teams shepherd thousands of entries every month, from citrus reefer containers to exotic sports cars. Below, we unpack what customs clearance involves, why compliance matters for every shipper, large or small, and how Transglobal turns a potential chokepoint into a competitive advantage.

What Exactly is Customs Clearance?

Customs clearance is the process of declaring imported or exported goods to SARS so the State can:

- Collect revenue —import duties, VAT, fuel levies, excise.

- Enforce regulations —prohibit counterfeit or unsafe products.

- Compile trade data —the numbers that drive economic policy.

In practice, clearance means assigning the correct HS code, declaring the transaction value, attaching permits (if needed), and submitting an electronic entry (SAD 500) through SARS’s Customs Processing System. Once the declaration is accepted and any duties are paid, SARS issues a release, and the port, depot, or airline lets your cargo go free.

Why Compliance Matters: Four Solid Reasons

The South African Customs Clearance Flow

Pre-alert & document review

Commercial invoices, packing lists, HS codes, and permits are checked before vessel arrival or flight departure.

Entry lodging (SAD 500)

Transglobal submits an electronic declaration via EDI.

Risk assessment

SARS channels the entry: Green (immediate release), Orange (doc check), and Red (physical inspection).

Duties & VAT

Paid on your deferment account or Transglobal’s bond.

Release & port out-turn

Release notifications hit TransIT; haulers schedule pickup.

Post-clearance audit

Transglobal archives documents for five years and assists if SARS calls for a desk audit.

Transglobal’s Customs Brokerage Services at a Glance

- Import cross-haul – Pulls cleared boxes from the harbor to the warehouse before demurrage hits.

- Export desk – Classifies new SKUs, lodges export entries, and ranges port or packing-depot delivery.

- Long-haul & HazChem transport – Fully HAZCHEM-compliant trucks move DG loads nationally, with spill kits and trained drivers.

- FCL, LCL & break-bulk handling – Container unpack/pack, palletization, and loose-cargo consolidation.

- Exotic-vehicle handling – Custom racking, bonded storage, SAPS clearances, CARB letters, both import and export.

- 24 / 7 tracking– Every truck, container, and ULD appears in TransIT for real-time milestone alerts.

Inside Transglobal’s Compliance Toolbox

- The tariff database is updated weekly with ITAC rulings and WCO notes.

- A valuation model that cross-checks Incoterms, freight, insurance, and royalties for accuracy.

- Permit pipeline that fast-tracks DAFF, NDOH, NRCS, and SAPS applications.

- AEO-style SOPs to cut Red-lane inspections, fewer unpacks, lower costs.

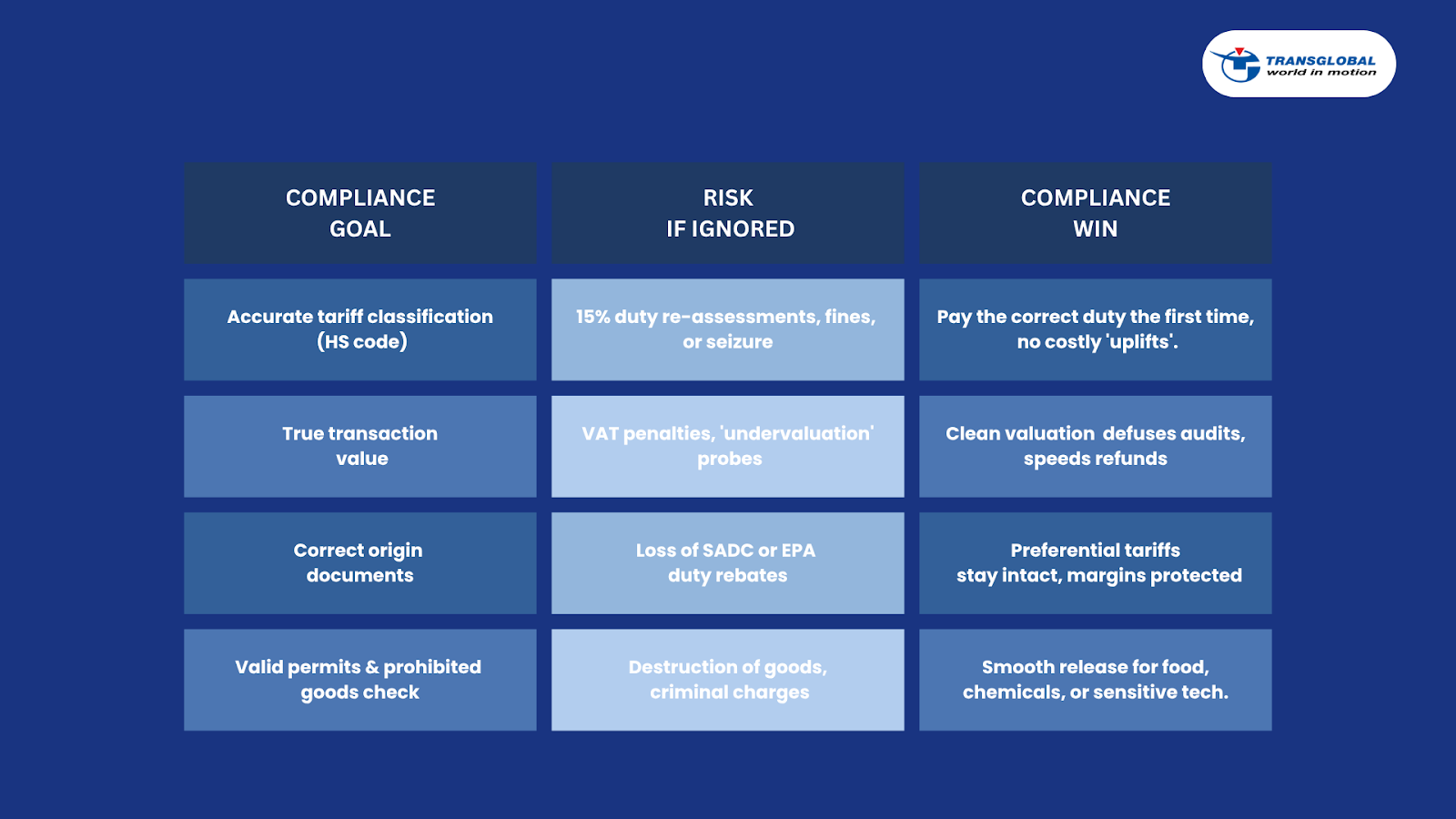

Benefits of Proper Customs Clearance Compliance

Operational Efficiency

When your documentation is accurate and submitted on time, it minimizes inspections, reduces delays at ports, and keeps shipments moving. This allows your supply chain to stay on schedule and supports better inventory planning and customer satisfaction.

Cost Management

While setting up a strong compliance system may seem expensive, it prevents far greater costs like demurrage fees, storage penalties, and unexpected customs fines. Over time, this proactive investment leads to major savings and better financial predictability.

Reputation & Relationships

SARS tracks your company’s compliance history through trader profiles. Consistent adherence to customs rules can earn you faster clearance, fewer inspections, and preferred status, giving you an edge over competitors who struggle with compliance.

Expanded Market Access

When you meet the terms of trade agreements, you qualify for duty reductions and simplified processing. This helps you expand into new markets with better pricing strategies and increased trust from international partners.

Common Compliance Challenges and Solutions

Regulatory Complexity

South African customs regulations are constantly evolving, and staying compliant means keeping up with tariff changes, permits, and new inspection policies. Frequent updates from customs brokers and trade associations can help businesses stay on top of these shifts.

Heavy Documentation Requirements

Incomplete or incorrect paperwork is a top cause of customs delays. Businesses should implement standard operating procedures (SOPs), digital filing systems, and employee training to avoid rejections and repeated corrections.

Technology Integration Gaps

Many companies still struggle to connect their internal systems with SARS’s digital platforms. Investing in API-ready or customs-integrated software can automate submissions and cut manual errors significantly.

Limited Resources in SMEs

Small and mid-sized businesses often don’t have a dedicated compliance team. Outsourcing customs clearance to licensed brokers or experienced freight forwarders gives them access to expert help without the need for in-house specialists.

Future Trends in South African Customs Clearance

Artificial Intelligence & Machine Learning

AI is being used to detect risky shipments and speed up classification. It reduces human error, flags inconsistencies faster, and improves customs authorities’ ability to target problematic cargo more accurately.

Single Window Clearance Systems

South Africa is gradually implementing a digital system that integrates customs, agriculture, health, and other inspections into one online platform. This will drastically simplify multi-agency approvals and reduce paperwork duplication.

Mutual Recognition Agreements (MRAs)

Customs may soon start recognizing compliance credentials from other countries. These agreements can lead to fewer inspections and faster processing for trusted traders dealing with international partners.

Environmental and Ethical Compliance

Future customs clearance may involve checks on carbon footprint, sustainability certifications, and labor compliance. Companies that prepare early for these criteria will be better positioned to meet emerging global trade standards.

Conclusion

Customs clearance is the invisible gate every shipment must walk through. One wrong HS digit or missing permit, and that gate locks tight, slowing deliveries, denting cash flow, and risking penalties. When the rules, the tariff schedule, and the paperwork feel like a maze, you need a guide who walks it daily.

Transglobal Cargo combines seasoned declarants, live-dash tracking, and a five-layer compliance system to move goods from quay or tarmac to customer without the red-tape headaches. Whether you’re importing a single pallet or a supercar, our customs brokerage desk keeps SARS satisfied and your supply chain on schedule. Ready to trade with confidence? Let Transglobal map out a customs-ready plan for your next shipment.

Frequently Asked Questions

What documents do I need for customs clearance?

You’ll need a commercial invoice, packing list, bill of lading or airway bill, HS codes, and any required permits. Transglobal ensures all documents are accurate and submitted on time to avoid delays.

How long does customs clearance take?

Clearance can take a few hours with correct paperwork, but inspections or errors can add days. Transglobal speeds things up with pre-alerts and experienced declarants.

Can Transglobal handle specialized cargo?

Yes, from dangerous goods to exotic cars, Transglobal has the permits, trained staff, and systems to clear high-risk and high-value shipments smoothly.

Comments